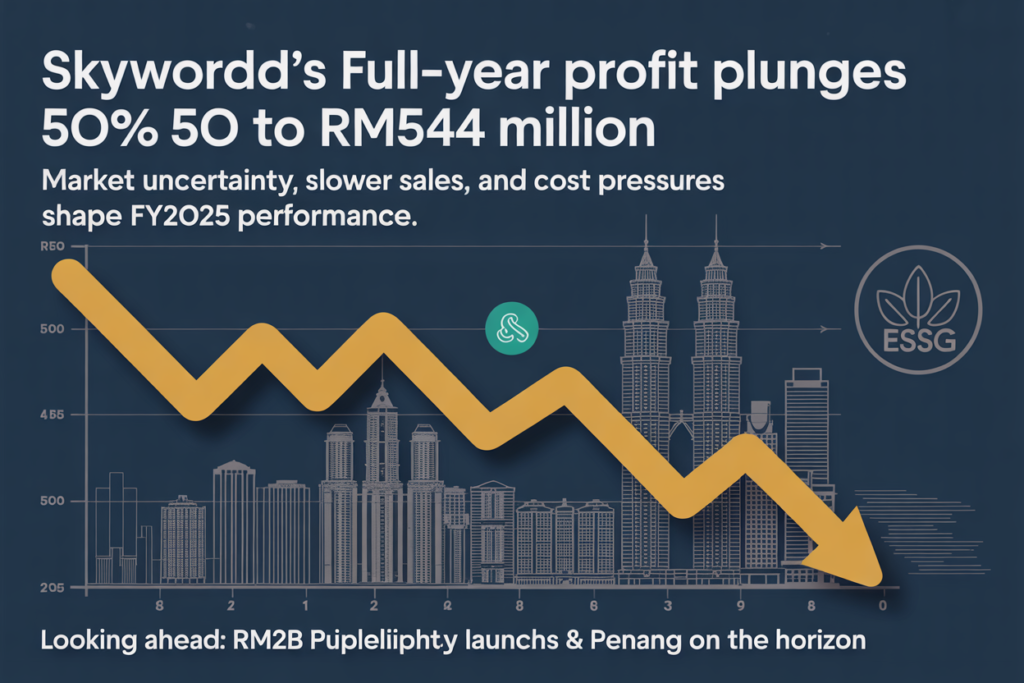

KUALA LUMPUR, May 23, 2025 – SkyWorld Development Berhad, a prominent urban property developer in Malaysia, has reported a sharp 50% decline in net profit for the financial year ended 31 March 2025. The group posted a profit after tax attributable to owners (PATAMI) of RM54.2 million, a significant drop from RM106 million recorded in the previous fiscal year.

Weaker Full-Year Revenue Reflects Market Challenges

SkyWorld’s full-year revenue plunged to RM445.4 million, down from RM688 million in FY2024. This considerable dip highlights the mounting pressures facing Malaysia’s property sector, as developers confront a combination of sluggish buyer sentiment, rising costs, and macroeconomic uncertainties.

The company’s fourth-quarter performance also mirrored the annual trend, with a PATAMI of RM16.4 million, lower than the RM20 million recorded in the preceding quarter. The results underscore the impact of a moderating property market, tighter credit conditions, and ongoing global supply chain issues that have affected construction timelines and costs.

CEO Lee Chee Seng Outlines Strategic Vision Amid Slower Earnings

SkyWorld’s Chief Executive Officer, Lee Chee Seng, acknowledged the challenges but maintained a forward-looking perspective. “Despite the current headwinds, we are confident in our strategic direction. Our landbank of 257.7 acres positions us well to continue our urban development goals,” he stated.

He also announced that SkyWorld is preparing for a major pipeline of property launches, particularly highlighting the upcoming maiden project in Penang. The company is targeting launches worth over RM2.0 billion in gross development value (GDV) for FY2026, contingent on market recovery and buyer appetite.

Resilient Landbank Supports Long-Term Development Plans

With a robust landbank across key urban centres, SkyWorld remains well-equipped to expand its footprint. The company’s land assets are strategically located in high-demand areas of Kuala Lumpur, Selangor, and now Penang, enhancing its potential to generate recurring income streams and capital appreciation.

Despite the downturn in FY2025, SkyWorld has demonstrated an ability to adapt its project pipeline, defer non-critical developments, and optimise operational efficiencies, all while remaining aligned with its long-term urban-centric vision.

Dividend Declared Amid Prudence in Capital Allocation

In line with its commitment to shareholder returns, the Board of Directors declared a final single-tier dividend of 0.5 sen per share for the financial year. While modest compared to previous years, this move reflects the company’s balanced approach to capital allocation, ensuring liquidity preservation amid market uncertainties.

This dividend declaration underscores SkyWorld’s intent to continue rewarding its shareholders despite reduced profitability, and its confidence in a recovery trajectory going forward.

Navigating a Complex Economic Landscape

Malaysia’s property sector, like many globally, continues to face significant headwinds. Rising interest rates, volatile building material costs, and currency fluctuations have exerted pressure on developers’ margins. Meanwhile, consumers are becoming increasingly cautious, preferring completed or nearly completed units with more attractive financing packages.

SkyWorld has responded by streamlining costs, focusing on high-demand property types, and integrating digital tools to enhance the buyer experience. These include online booking systems, 3D virtual showrooms, and hybrid customer engagement models to facilitate property sales.

Outlook: Cautious Optimism for FY2026

Looking ahead, SkyWorld’s management has projected “cautious optimism” in its FY2026 outlook. The group aims to weather ongoing market volatility by executing strategic launches, particularly in underserved markets like Penang, and tapping into affordable housing segments.

CEO Lee reiterated the company’s commitment to delivering value-driven developments, enhancing customer trust, and leveraging its brand equity. He added, “Our strong foundation and market understanding give us the confidence to navigate these challenges and seize emerging opportunities.”

Penang Maiden Launch: A Potential Catalyst

SkyWorld’s first foray into Penang’s property market is being closely watched by industry analysts. This maiden project, expected to launch in the second half of FY2026, is seen as a strategic expansion move that could diversify revenue streams and offset softer performance in the Klang Valley.

Penang, with its growing population and limited land availability on the island, presents a lucrative opportunity for high-quality, affordable urban housing. SkyWorld’s reputation for delivering integrated, well-designed communities may give it a competitive edge in this new region.

Ongoing Commitment to Urban Sustainability and Innovation

SkyWorld continues to integrate green building practices, digitalisation, and ESG principles into its core strategy. The company remains committed to achieving higher sustainability standards, with its developments certified by GreenRE and GBI (Green Building Index).

Innovations in project planning, waste reduction, and water conservation have helped the group maintain operational efficiency while reducing environmental impact a crucial factor for future-conscious investors and homebuyers.

Key Financial Highlights FY2025 vs FY2024

| Metric | FY2025 | FY2024 | % Change |

|---|---|---|---|

| Revenue | RM445.4 million | RM688 million | -35% |

| PATAMI | RM54.2 million | RM106 million | -49% |

| Q4 PATAMI | RM16.4 million | RM20 million | -18% |

| Dividend | 0.5 sen | 1.0 sen (estimated) | -50% |

These figures illustrate the challenging year SkyWorld endured but also reflect its capacity to remain profitable in the face of macroeconomic disruption.

A Transitional Year for SkyWorld

FY2025 marks a transitional phase for SkyWorld Development Berhad. While financial results were muted, the company’s forward strategies, disciplined execution, and prudent financial management have laid a resilient foundation for growth.

Its focus on urban-centric development, strategic landbank utilisation, and targeted launches in high-demand areas like Penang sets the stage for a potential rebound. The coming year will be critical as SkyWorld seeks to restore momentum, deliver on its pipeline, and reaffirm investor confidence.