Understanding the Carbon Credit Market: A Global Overview

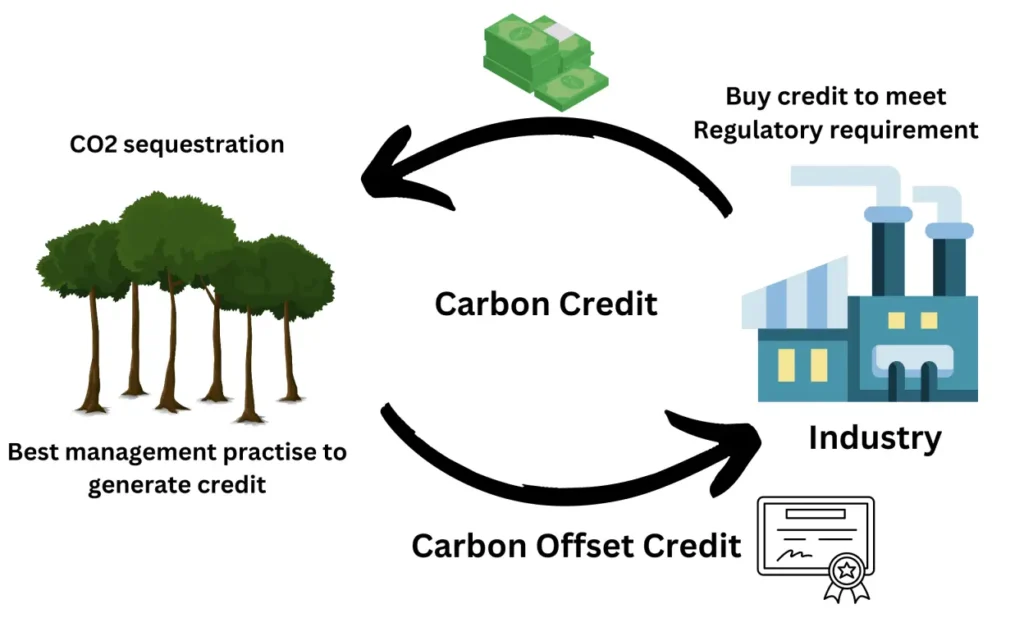

The carbon credit market is a fast-evolving system designed to reduce global greenhouse gas emissions by placing a financial value on emitting carbon. It functions under a cap-and-trade or voluntary offset model, where entities either receive allowances to emit a certain amount of CO₂ or voluntarily purchase credits to offset their emissions. Each carbon credit equates to one metric ton of CO₂ either removed from the atmosphere or prevented from being emitted.

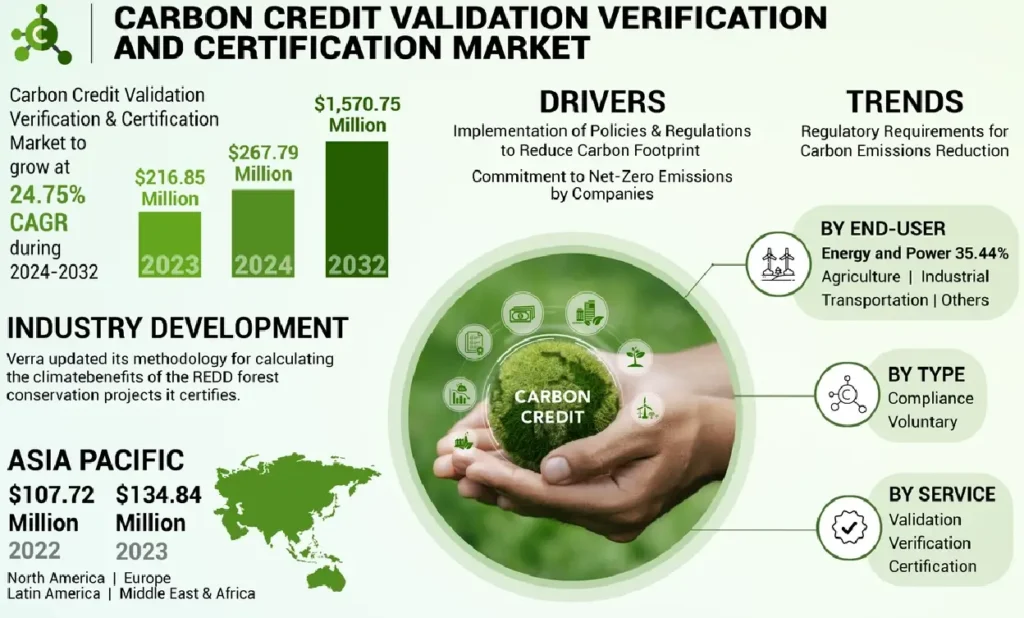

As global environmental policies tighten and climate risks become mainstream financial concerns, carbon credits have turned into high-value assets. Countries and corporations are under increasing pressure to decarbonize, and the demand for credits is rising sharply—especially in Asia-Pacific regions poised for green transformation, including Malaysia.

Malaysia’s Position in the Carbon Credit Ecosystem

Malaysia, with its rich biodiversity, expansive forest cover, and strong commodity-based economy, stands uniquely positioned to capitalize on carbon credits. The country holds over 55% of its land under forest cover, according to government estimates. These forests act as natural carbon sinks, providing a perfect foundation for nature-based carbon offset projects, such as reforestation, afforestation, and forest conservation initiatives.

The Malaysian government has already made strides in embracing carbon markets, including the establishment of Bursa Carbon Exchange (BCX), Southeast Asia’s first Shariah-compliant carbon market. Launched under the Bursa Malaysia Group, BCX aims to provide a voluntary marketplace where local and global entities can purchase verified carbon credits sourced from domestic and international projects.

Opportunities for Malaysian Businesses and Landowners

Malaysia’s potential to profit from going green lies in both the supply and demand sides of the carbon market. On the supply side, Malaysian landowners, forestry operators, and plantation owners can develop carbon projects by:

- Conserving existing forests

- Reforesting degraded land

- Adopting regenerative agriculture

- Capturing methane from palm oil mills

These projects, when verified by recognized carbon standards like Verra, Gold Standard, or the UNFCCC, can generate certified credits. These credits can then be sold through platforms like BCX or international exchanges to buyers looking to offset their carbon footprint.

On the demand side, Malaysian corporations—especially those in sectors such as energy, oil and gas, logistics, and manufacturing—can purchase carbon credits to meet ESG targets, improve their sustainability profiles, and prepare for potential carbon taxes or import regulations in global trade, such as the EU Carbon Border Adjustment Mechanism (CBAM).

The Role of Policy and Regulation

To unlock the full potential of carbon markets, Malaysia must continue developing a robust regulatory framework. This includes clear guidelines on carbon rights, land tenure, measurement, reporting, and verification (MRV) systems, and legal recognition of carbon credits as tradeable assets.

The government has signaled commitment through the Twelfth Malaysia Plan and its Nationally Determined Contributions (NDCs) under the Paris Agreement. Malaysia aims to reduce greenhouse gas emissions intensity by 45% by 2030 relative to 2005 levels. This ambition opens the door for comprehensive support for carbon trading, particularly for projects that offer social and environmental co-benefits.

Additionally, the inclusion of indigenous communities and local stakeholders in carbon projects is critical. Ensuring equitable revenue-sharing models and participatory governance will enhance project success and community acceptance.

Economic and Environmental Benefits of Participation

Participating in carbon credit markets offers Malaysia both financial incentives and ecological resilience. These include:

- Revenue Generation: A well-developed carbon project can generate millions in revenue, especially if it earns premium-priced credits with co-benefits like biodiversity protection and social impact.

- Rural Development: Carbon projects can bring investment, jobs, and infrastructure to rural and indigenous communities.

- Climate Resilience: Protecting forests and adopting sustainable land use mitigates climate impacts like flooding and drought.

- International Positioning: By actively engaging in the carbon economy, Malaysia enhances its reputation as a responsible, forward-looking nation, which can improve investor confidence and trade relations.

Key Challenges in Monetizing Carbon Credits in Malaysia

Despite its potential, there are notable challenges:

- Verification Costs: The process of developing and verifying a carbon project is expensive and time-consuming.

- Data Deficiency: Accurate, satellite-based data for MRV remains underdeveloped in some regions.

- Market Fragmentation: Competing standards and platforms can confuse buyers and sellers.

- Policy Uncertainty: Frequent shifts in policy or lack of clarity on carbon rights can deter investment.

Addressing these challenges will require public-private partnerships, investment in capacity building, and international cooperation with technical agencies and financiers.

Malaysia’s Roadmap to Becoming a Carbon Credit Powerhouse

To fully benefit from the global green transition, Malaysia must take deliberate steps:

- Strengthen Institutional Frameworks: Establish centralized bodies to oversee carbon project approval, monitoring, and enforcement.

- Educate Stakeholders: Equip landowners, SMEs, and corporate buyers with knowledge on how carbon markets work.

- Develop Carbon Inventory Systems: Invest in geospatial data, AI, and remote sensing to map and track carbon assets nationwide.

- Encourage Investment in Green Technology: Offer tax incentives for companies investing in emissions reduction and carbon capture tech.

- Foster Regional Collaboration: Lead ASEAN-level initiatives to build a unified carbon market framework.

By taking these steps, Malaysia can shift from being a carbon emitter to a carbon innovator, using its natural capital as a strategic economic resource.

A Green Future with Economic Promise

The carbon credit market presents a significant economic opportunity for Malaysia. With its abundant natural resources, supportive policies, and growing ESG awareness, Malaysia is poised to become a key player in the global green economy. Through strategic development, education, and enforcement, Malaysia can not only meet its climate targets but also generate new income streams, empower local communities, and enhance national competitiveness.